22+ mortgage tax benefits

Web The TCJA limited the deduction to interest on up to 750000 of mortgage debt incurred after December 14 2017 to buy or improve a first or second home. If you get a 100 deduction.

Pdf Effects Of Financial Crisis On The Macroeconomic Indicators And Possible Solutions To Redress For Romanian Economy Borlea Nicolae Sorin Academia Edu

Homeowners can deduct interest expenses on up to 750000 of mortgage debt from their income taxes though when they itemize these deductions.

. Web The mortgage interest deduction allows you to reduce your taxable income by the amount of money youve paid in mortgage interest during the year. For married couples filing. But the Tax Cuts and Jobs Act reduced the amount you can.

An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Companies are required by law to send W-2 forms to. So if you have a.

Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Ad A reverse mortgage gives you the power to unlock your homes equity while you live in it. Web But Sallys mortgage interest and property taxes total 9280 in deductible costs and subtracting those expenses brings her total taxable income down to 60720.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web Advance Child Tax Credit. Web Married taxpayers filing a joint return.

Ad Get 3 alternative investments with higher yields that could make your mortgage free. Web My mortgage company however says that the state letter itself is not acceptable for tax exemption and they want bills from the local taxing authorities in order to process it. By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. The amount of credit you. If you owe 1000 and get a 100 tax credit your tax bill drops to 900.

Web Important tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now. Expert says paying off your mortgage might not be in your best financial interest. If you are over 65 or blind youre.

Web Basic income information including amounts of your income. However the Tax Cuts and Jobs Act has reduced this limit to 750000 as a single filer. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes.

Web The tax deduction for mortgage interest is one of the most valuable tax breaks for homeowners. Married taxpayers filing separately. Web The Loan Against Property tax benefits depends on how the borrower will utilise the funds acquired.

It is to be noted that only the interest on the loan is eligible for. Web Most homeowners can deduct all of their mortgage interest. Web A tax credit reduces how much tax you pay dollar for dollar.

Web In the past homeowners could deduct up to 1 million in mortgage interest. Web If youre an individual taxpayer or married couple filing a joint return you can claim the interest paid on up to a 750000 mortgage.

Mortgage Interest Tax Deduction What You Need To Know

:max_bytes(150000):strip_icc()/credit-score-factors-4230170-v22-897d0814646e4fc188473be527ea7b8a.png)

The 5 Biggest Factors That Affect Your Credit

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Pdf Biodiversity Damaging Subsidies In Switzerland

Corporate Intl Who S Who Adviser Handbook 2020 By Utopia Ventures Limited Issuu

2021 Tax Benefits For Homeowners Ovm Financial

The Tax Benefits Of Owning A Home Must Know Deductions And Credits Credible

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Coming Home To Tax Benefits Windermere Real Estate

6 Tax Breaks Every First Time Homeowner Should Know About

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Mortgage Interest Deduction How It Calculate Tax Savings

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Direct Tax Laws And International Taxation By Ca Mehul Thakker By Mtliveca Issuu

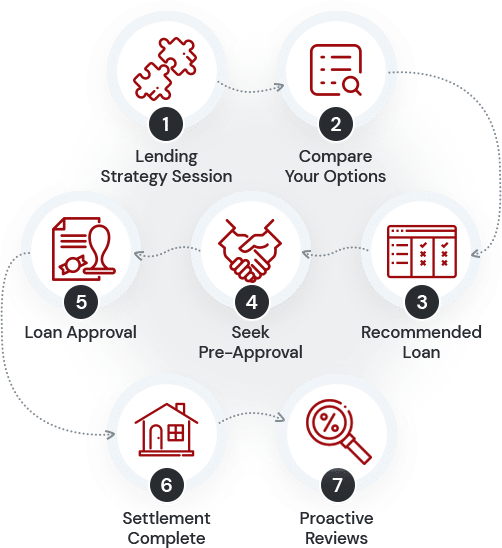

Investor Loans Geelong Bellarine Peninsula

Are Total Taxes Higher In The Usa Or Europe Quora