Td home equity line of credit payment calculator

Some of the factors that affect the timeline include the type and terms of the home loan youre requesting the types of documentation required in order to secure the loan and the amount of time it takes to provide your lender with those documents. Your estimated prepayment charge is calculatorpaymenttotal currency2.

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

To demonstrate this concept lets take a closer look.

. Personal lines of credit. One downside of a home equity line of credit. Ranging from 50 to 100 of the value of the investment type.

In exchange for an available cost reduction or waiver if you pay off and close the loan within a certain period usually three years you may. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. TD Home Equity FlexLine.

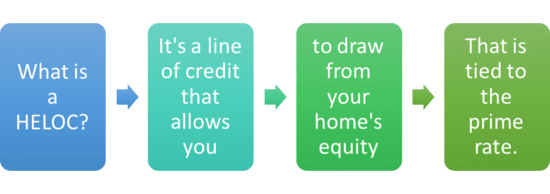

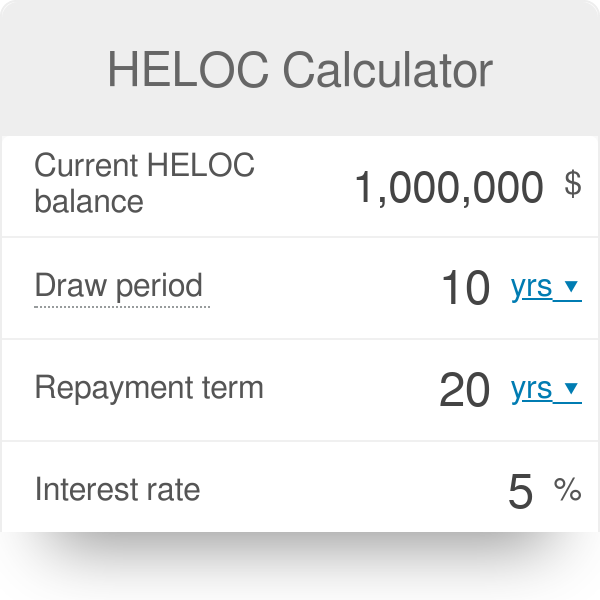

Use this calculator to see how much you would need to prepay before you request a Payment Vacation. Remember youre only charged interest on the home equity line of credit amount you draw so theres no cost in having as large a HELOC limit as possible. A home equity line of credit or HELOC is a type of home equity loan that works like a credit card.

Beware of the catch though. The HELOC rate is typically 080-140 higher than a comparable 5-year variable mortgage rate so there is a premium that you pay for all of these perks. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies.

Lender APR Introductory APR Line Amount Range HELOC Terms Max LTV. But if you do have a balance then the only. Every home loan situation is different so its hard to estimate how long your specific home mortgage process will take.

Youre given a line of credit thats available for a set time frame usually up to 10 years. An example of a home equity line of credit with a paid off property. Home equity loan closing costs and fees.

Up to 80 of the value of your home. 1000 to 350000 Investment Secured Line of credit. A home equity line of credit or HELOC allows you to borrow against the equity of your home at a low cost.

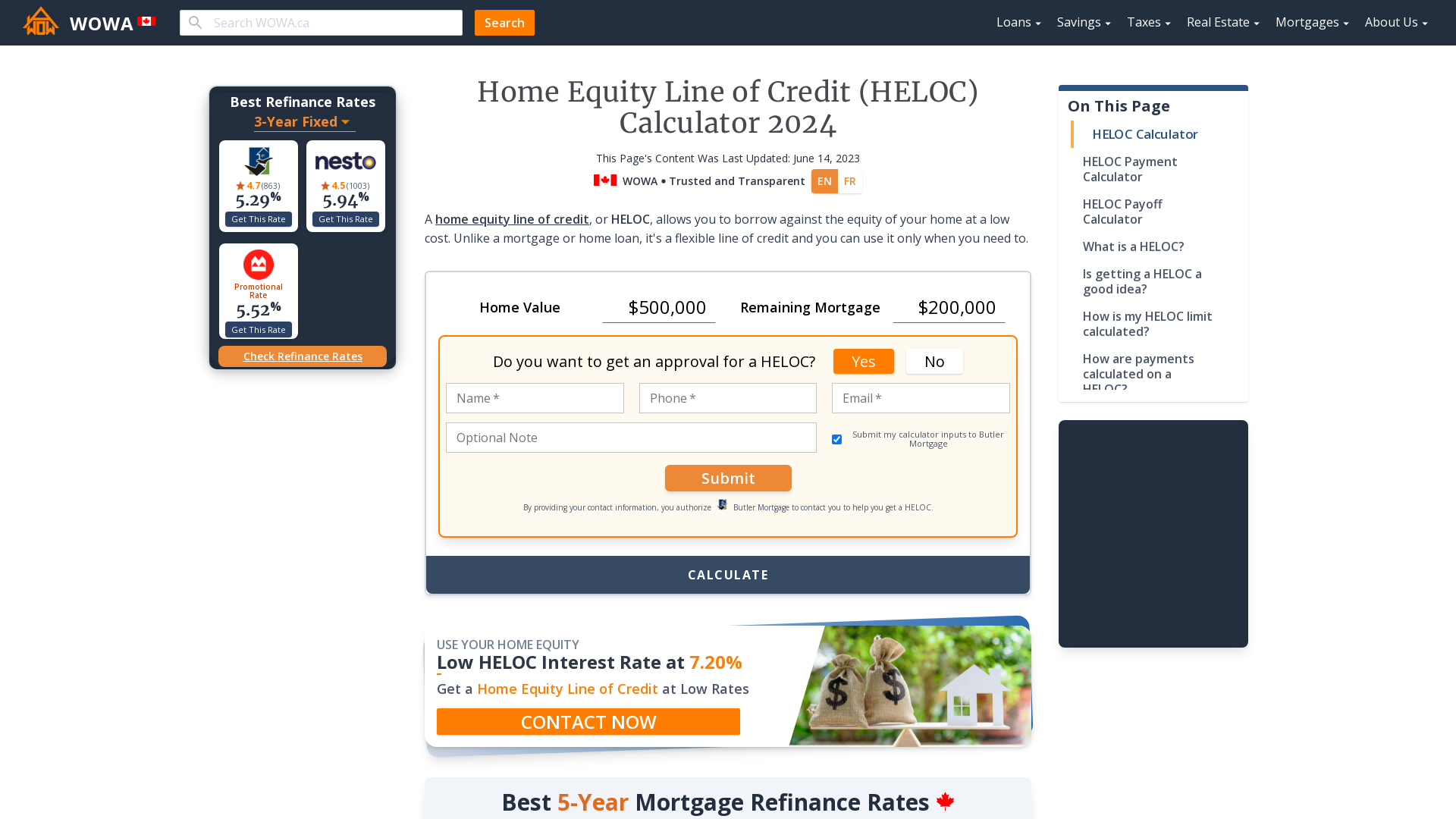

Although some lenders may reduce or waive them altogether home equity loan closing costs typically range anywhere from 2 to 5 of the loan amount. How can I use a home equity line of credit. To qualify for a home equity line of credit is largely the same process as qualifying for a mortgage.

Making prepayments can mean you pay less interest over the lifetime of your mortgage or term portion on your Home Equity Line of Credit HELOC or TD Home Equity FlexLine. 1000 to 80000 Student Line of credit. Mortgage Prepayment Calculator Making prepayments is a great way to pay less interest over the lifetime of your mortgage or term portion on your Home Equity Line of Credit HELOC or TD Home Equity FlexLine.

15000 to 750000 up to 1 million for properties in California. 5000 to 50000 Student Line of credit. But depending on the terms you may pay a prepayment charge.

520 Promotional Rate. Unlike a mortgage or home loan its a flexible line of credit and you can use it only when you need to.

Pin On Banking Human

Home Equity Line Of Credit Qualification Calculator

How A Heloc Works Tap Your Home Equity For Cash

Contact Mr Elias Vouloumanos For Any Advice Or Suggestions Related To Mortgages Our Specialists Can Answer Your Question Mortgage Gaming Products Specialist

Td Bank 2022 Home Equity Review Bankrate

Home Lending And Mortgage Rate Calculator Td Bank

Here Are 3 Reasons To Refinance Your Mortgage Mortgage Interest Rates Mortgage Rates Mortgage Loans

Pros And Cons Of Home Equity Loans Bankrate

Collateral Loan For Personal Or Business Purposes Collateral Loans Personal Loans Contract Template

Tumblr Commercial Loans Small Business Loans Business Loans

Home Equity Loans Forbes Advisor

Heloc Calculator

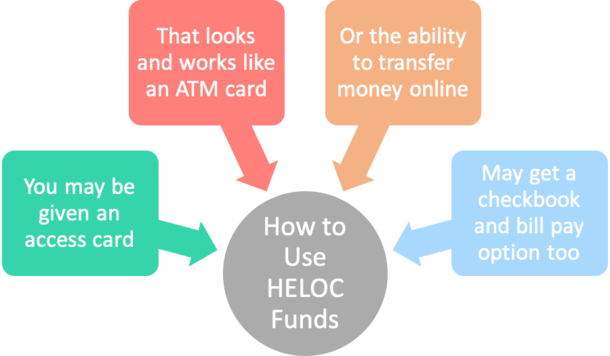

Heloc Calculator Calculate Available Home Equity Wowa Ca

Credit Cards Rbc Royal Bank Credit Card Statement Visa Credit Card Application

Interest Only Heloc Explained Nextadvisor With Time

How A Heloc Works Tap Your Home Equity For Cash

/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Secured Vs Unsecured Lines Of Credit What S The Difference